Program Overview

In today’s times the world is constantly changing causing the market place to morph into a more volatile environment. Governmental interventions, erratic weather conditions, constantly changing global demographics and pressure to produce greater quantities of Natural resources are the integral components which determine this dynamic. This volatility allows investors increased opportunities in achieving alpha through a non-correlated vehicle by capturing price discrepancies in the underlying commodity based on its fundamental value.

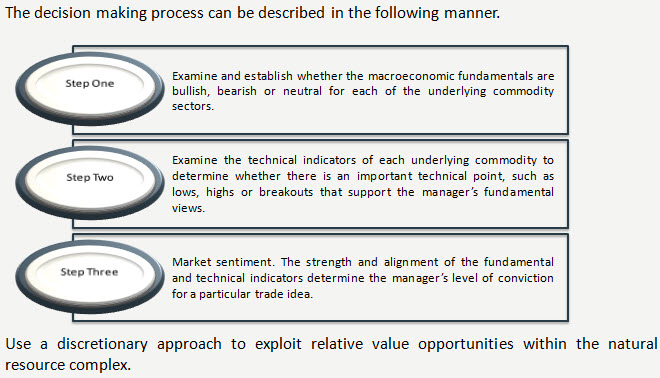

The NRD-1 is a Natural Resource, commodity only program co-managed by Nicholas Gentile and Steve Lampe. Trading is discretionary and uses both fundamental and technical analysis, with the ultimate determination based on fundamentals. Trading decisions are developed through highly extensive, statistically based analysis, review of supply and demand conditions, inventory levels, weather developments and forecasts and economic trends and reports. This in conjunction with the managers in depth knowledge of markets and physical commodity trading experience is also strengthened by a vast network of industry contacts developed over 25 plus years. No position is taken unless both traders are in agreement on position level, profit objective and trading plan.

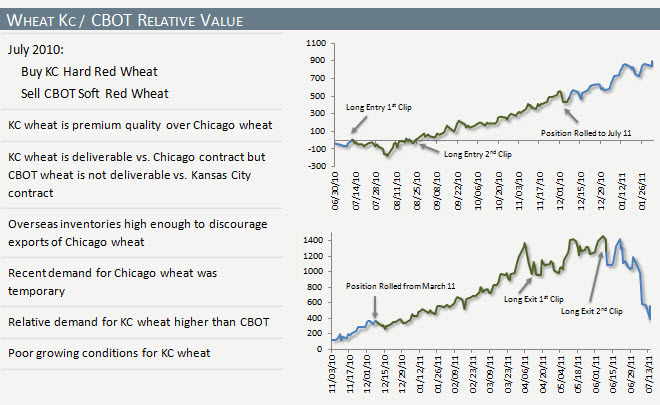

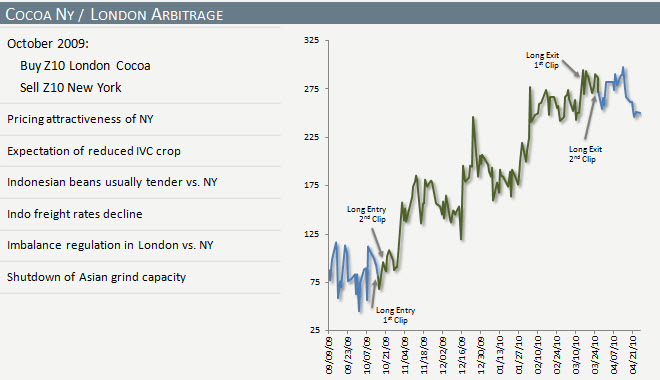

The program incorporates flat price directional trading composed of intraday, medium and long term trades in congruence with relative value trades consisting of inter commodity strategies, Arbs and both seasonal and calendar spreads. Trades are outright futures positions and a small percentage of the time structural futures and option trades.

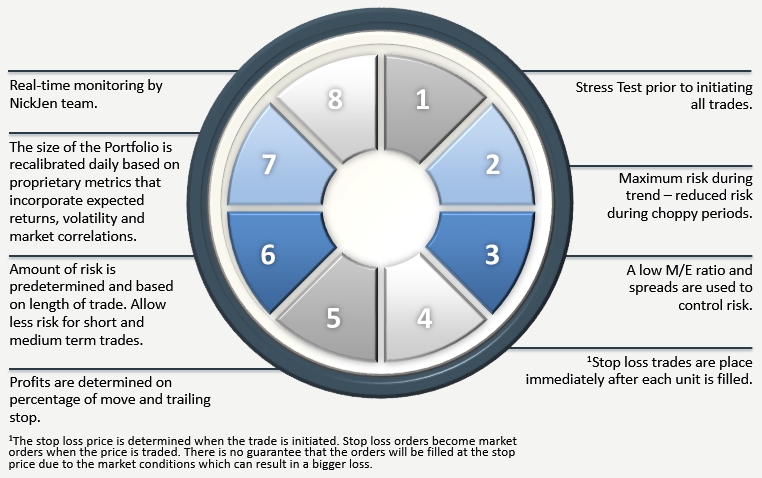

NickJen Capital employs strict risk parameters which are monitored in real time through the company’s internal risk management system and electronic trading platforms. The company’s Chief Risk Officer regulates and administers the internal system. We also utilize a fully integrated and scalable risk system and have a strong focus on operations and controls.